Table of Contents

Is intraday trading profitable is the question which hit my mind , when I started trading as a beginner 3 years back . That time my thinking was to only make huge money quickly through trading and started learning stock market trading .

Not only that time , again the same question hit my mind after wiping out all of my capital used 2 years back . That time I learnt basics and technicals of stock market trading i.e price action . During this phase , I was continuously making losses in the market .

Third time , the same question it hit my mind 1 year back when i was into break even stage . That period of time , I also learnt risk management , money management . During this phase , some days I’m profitable and some days I’m at a loss.

Today if you ask the same question to me i.e is intraday trading profitable ?

My answer will be absolute YES.

Why I’m able to say YES is because now I’m making consistent money from intraday trading . Today I understood how one can become profitable making money in intraday trading.

In this article , I’m going to reveal the secrets and lessons which I learnt to become profitable in intraday trading .

Secrets of Trading

Trading is a game of probability and making odds work in your favor, because that is the only way to become profitable in intraday stock trading .

For you to understand the secrets of trading on how to become profitable in intraday trading , you should understand the winning rate and risk reward ratio.

Winning rate for trading

Winning rate for trading or accuracy of the strategy is how many percent of trades will result in profit in the total number of trades you place in the market .

For example , if 5 of your trades will result in profit in the total of 10 trades then the winning rate will be 50%.

Similarly, if you win 6 times out of 10 trades you take , the winning rate or accuracy of your strategy is 60% in this case .

Trading Risk reward ratio

For each trade , you execute in the stock market what % of reward (profit) you will gain by risking what % of the amount is called as risk reward ratio .

It is mentioned risk % : reward % .

Risk reward ratio per trade = reward gained per trade / risk kept on that trade .

For example , if you have risked 1000rs on a trade and made profit of 5000 rs on that trade means your risk reward ratio is 1:5

Similarly , if you risk 1000rs and make a profit of 11000 rs on that trade means your risk reward ratio is 1:11 .

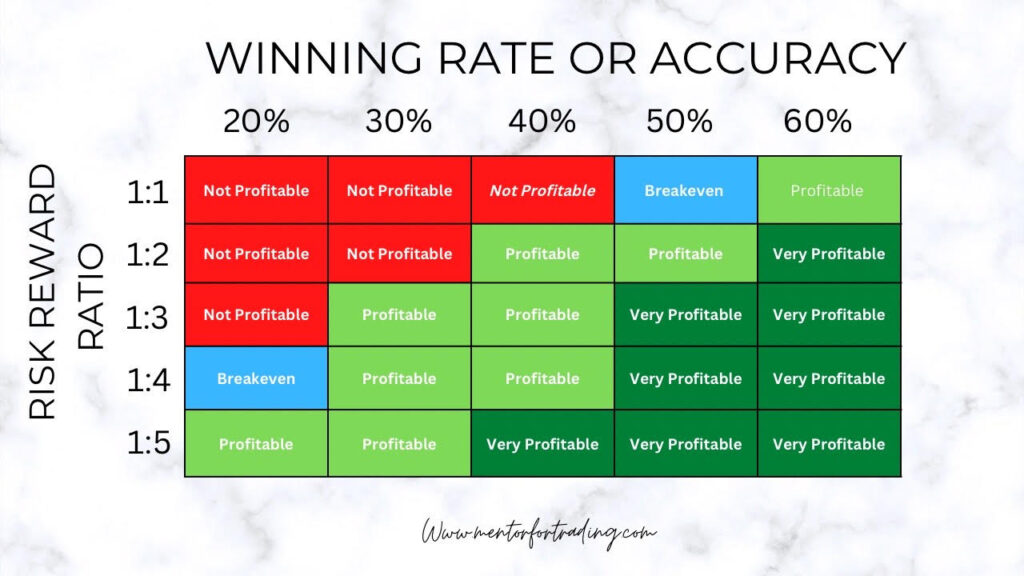

Now you would have understood the winning rate and risk reward ratio of trading . Look at the table below to understand how to become profitable in intraday trading .

According to the data in the table , if you have a strategy with 50% win rate and 1:2 risk reward ratio , then you are a profitable trader in intraday trading .

Now the challenge is to find the strategy which gives higher accuracy or higher risk reward ratio.

Why because , Win rate is inversely proportional to risk reward ratio .

Either try to increase the win rate of the strategy or the risk reward ratio of the trade to become profitable in intraday trading .

How to improve accuracy of strategy in stock intraday trading :

Every trade you execute in a market , it has three possible directions to move i.e upside , sideways and downside .

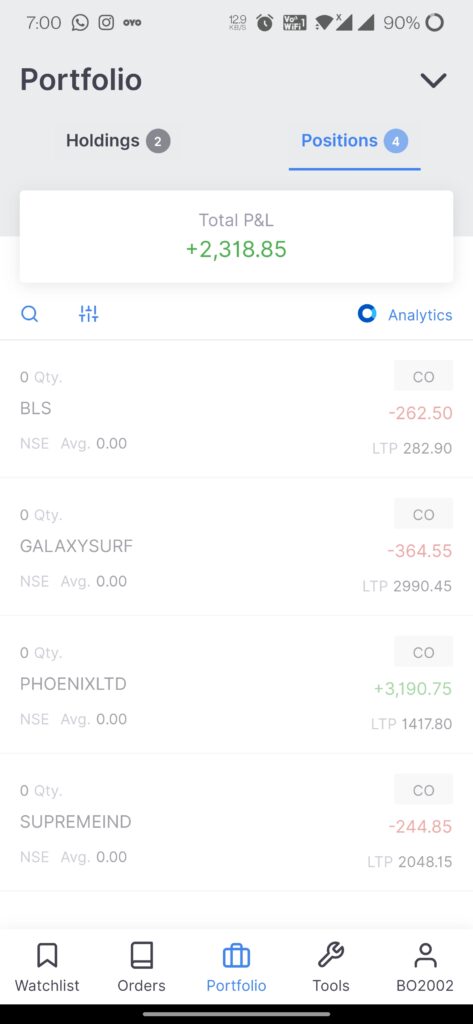

What I do to improve the win rate is to take two long positions and two short positions on any day (total 4 positions per day) . So if the overall market moves upside , my long positions will move in my favor and vice versa .

In the screenshot , you can see a total of 4 trades executed on a day with 250rs risk per trade.

On this particular day , the stock market was bullish so the one of the two long positions which I took gave huge returns .Both the short trades hit my stop loss.

If I would have taken only short positions on this day , then I would have made a loss on this day. So to improve accuracy , take positions on both sides or do hedging .

How to improve intraday risk reward ratio :

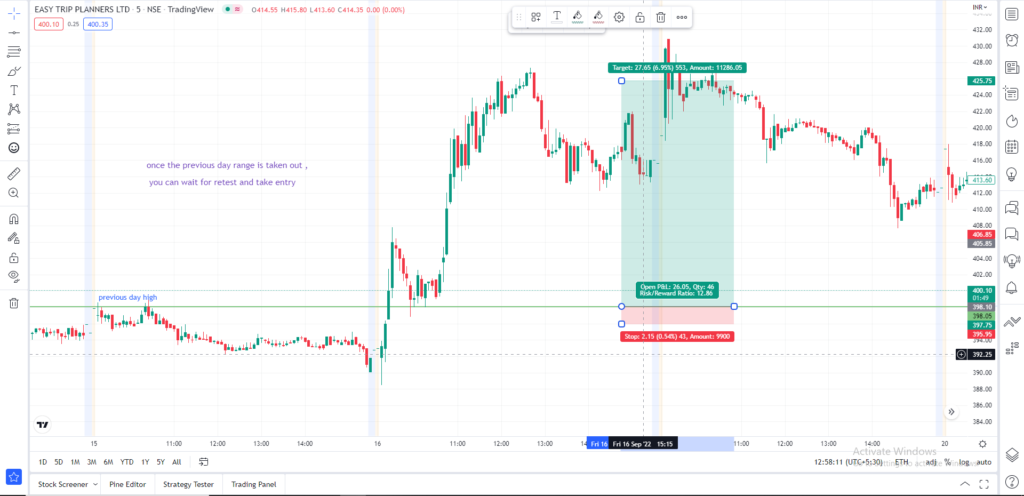

To improve the risk reward ratio per trade , I worked on my strategy part I.e instead of taking entry in break candle , I take entry in retest area .

Why I enter on retest is that , easily I can able to get good risk reward ratio .

From the chart , you can see that in this trade alone I achieved 1:12 risk reward ratio. Because I took an entry on retest rather than on breakout.

Now you might ask me , where to take my entry if stock doesn’t retest after breakout?

In that scenario , it is better to switch to another stock which is giving a retest . Trust me on any given day , you will have many opportunities on stock intraday trading .

Conclusion on is intraday trading profitable:

“Trading is a game of probability and making odds work in your favor”

To make odds work in your favor , you need to improve the winning rate and risk reward ratio of trading.

I’m following a strategy which has a 30% to 50% winning rate and minimum average risk reward ratio of 1:5 .

Now look at the chart and the positions screenshot and tell me whether is stock market profitable or not ?

Yes, right . so it is possible to become profitable in intraday trading .

Now the question is DO YOU WANT TO BECOME PROFITABLE IN INTRADAY TRADING ?

If your answer is yes , start learning and take necessary actions now . Most important element to become profitable is to find a trading mentor who can help you achieve your dreams.

What are long and short positions in trading?

Long position:

Long position in trading is buying a stock first into your trading account and selling the stock when it reaches the target or stop loss.

It is termed as long or buy in stock market terms. We do long the stock only if we are bullish on the stock.

Short position:

Short position in trading is selling the stock first which we don’t own and buying the same stock later at target or stop loss . It is otherwise called short selling .

It is termed as short or sell in stock market terms. We short the stock only if we are bearish on the stock.