Table of Contents

The nr7 intraday strategy is a very popular strategy used by almost all the intraday traders in the stock market. The nr7 strategy was introduced by Tony Crabel in the year 1990. That means intraday traders have been following this intraday strategy for 32 years.

Many successful traders in India started their trading journey with NR4 and NR7 intraday strategy chart link. It is the most used strategy intraday because of its volatility and reliability.

If you are a beginner in intraday stock trading , the first strategy you should learn and implement is nr4 and nr7 intraday strategy.

Being a successful stock trader for more than 3 years , I have utilized the nr7 strategies many times practically in live markets and understand the logic behind the strategy . But also the ways to improve the winning rate of the strategy .

In this article , I’m not only going to discuss how to use nr7 strategy but I will explain the logic behind the strategy and how to become profitable in intraday trading by using this strategy .

If you want to know the logic behind nr7 strategy , first you should understand the basic thing of stock price movement in the stock market .

What makes a stock move in the stock market ?

You might wonder what makes the stock price move in the chart every second . Reason is because of the supply and demand in the market .

Let’s say more people are ready to buy the stock price at a certain level than sellers , then at that particular moment the stock price will rise in the market . In this scenario , demand is higher for that particular stock .

In the other scenario , if more people are ready to sell the particular stock than the buyers at a certain price level i.e Supply is higher than the demand ,then the stock price will fall in the market.

So the basic principle behind the stock movement is demand and supply in the market .

How stock prices move in the stock market ?

Richard Wyckoff created Wyckoff theory through technical analysis to understand how the stock price moves in the stock market .

A stock price always follows the cycle of consolidation and breakout. Because it follows the wyckoff theory of accumulation and distribution .

Let’s dig this terms deeper and understand the logic behind stock movement

Consolidation in trading:

Consolidation is a phase in which the stock price moves in a range . Otherwise we can tell that the price moves in the sideways movement in a particular price range .

Breakout:

After the stock price is in a range , if it moves massively in the upward direction then it is called breakout. Also in this phase , price moves in a trend

Breakdown:

It is similar to breakout , only difference is it gives massive movement in downward direction after the consolidation phase.

So if we are able to identify where the trendy movement starts i.e breakout, then we buy that stock and sell at the higher cost to yield profit .

What is the Nr7 strategy?

Narrow range 7 , the name indicates that out of the 7 consecutive days candle , the current day candle is the narrowest or smallest candle compared to the previous 6 days candle .

Nr7 means that price is consolidating in the narrower range for about seven consecutive days . Once the breakout or breakdown happens from this range , we can expect a huge movement in the up or downside based upon the breakout type.

To learn and execute the Nr7 strategy , you should know

- how to scan stocks for intraday trading

- How to enter in that stock

- How to exit and make profit or loss

How to scan stocks for intraday trading

1. scan manually

First method of selecting stocks for intraday trading is to scan stocks one by one in your broker . It is the old method of short listing the stocks.

In this method , you need to see whether the current day candle is NR7 candle or not and if it is NR7 candle then shortlist in your watchlist .

At Least add 10 stocks in your watchlist for next day to trade .This is how you need to scan and shortlist the stocks for intraday trading .

2. Use screener like chart ink

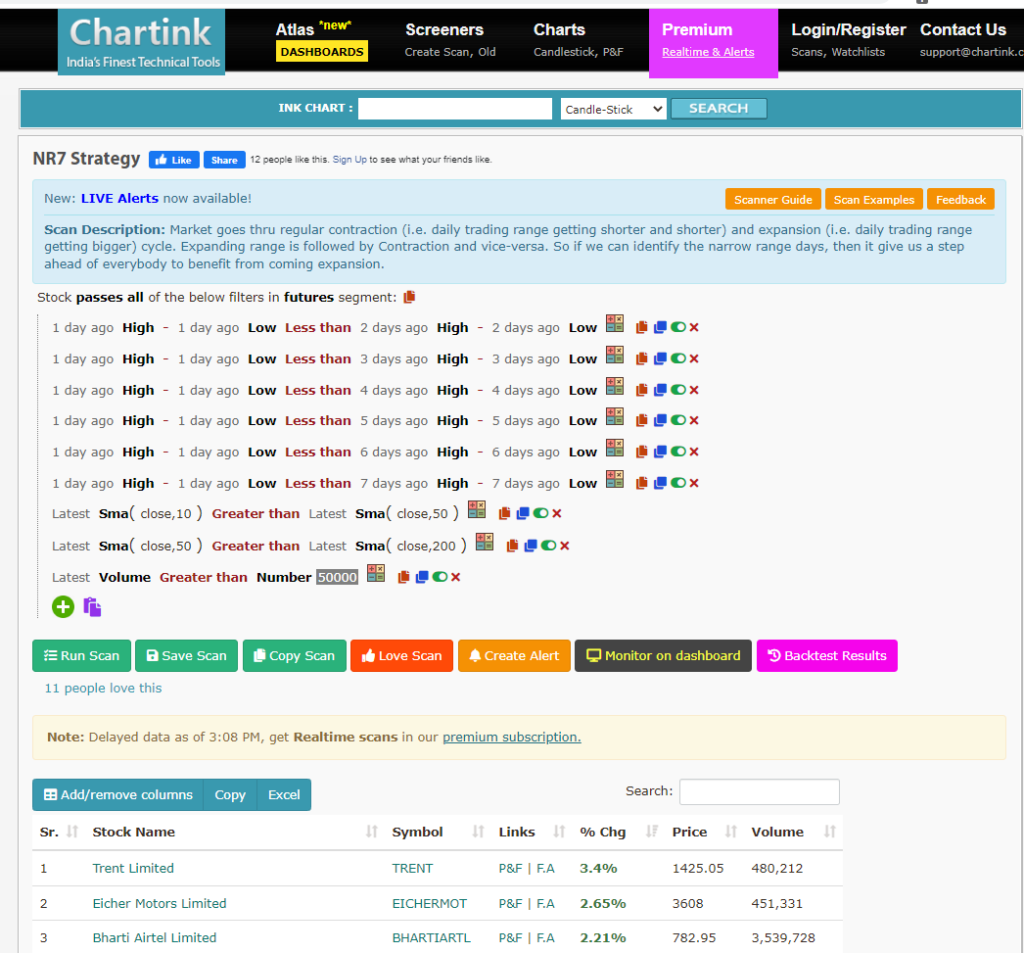

The second method of selecting and shortlisting the stocks is to use the screener like chartink . The screener is the software which scans the stocks on particular condition say NR7 and gives us the watchlist

If you visit the NR7 chartink ,you can see all the stocks which come under the condition NR7. Your watchlist is ready in seconds .

In this screener method of scanning, You don’t need to scan stocks by spending hours of time in front of the monitor post market hours .

How to decide entry and exit in intraday trading – NR7 strategy ?

1. First mark the high and low of the current day candle i.e NR7 Candle using the horizontal line in your charting software like tradingview.

2. Now wait for market to open at 9.15am , ignore all the stocks which open above the resistance line which we have drawn and also ignore those stocks which open below the support line

3. Only watch the stocks which open within the range , once the strong candle closes above the line I.e breakout . Do long entry in this stock with a calculated quantity and strict risk management .

4. If the breakdown happens with good volume I.e strong candle closes below the line . Trigger your short entry in that stock .

5. The stop loss will be above the breakout candle and stoploss will be below the breakdown candle .

6. Target will be with the minimum risk reward ratio of 1:3 depending upon the market condition.

Conclusion on NR7 intraday strategy chart link :

Now that you have learnt the NR7 strategy completely in this article . Now comes the interesting question I.e

Is only learning the strategy enough to make money from the stock market through intraday trading ?

Definitely NO.

Because in the stock market , executing the strategy is more important than learning it . Practice this strategy as many times as possible and build conviction in this NR7 strategy .

Also , you should learn the important aspects of intraday trading I.e How to earn from intraday trading and detailed plan to become profitable in intraday trading.